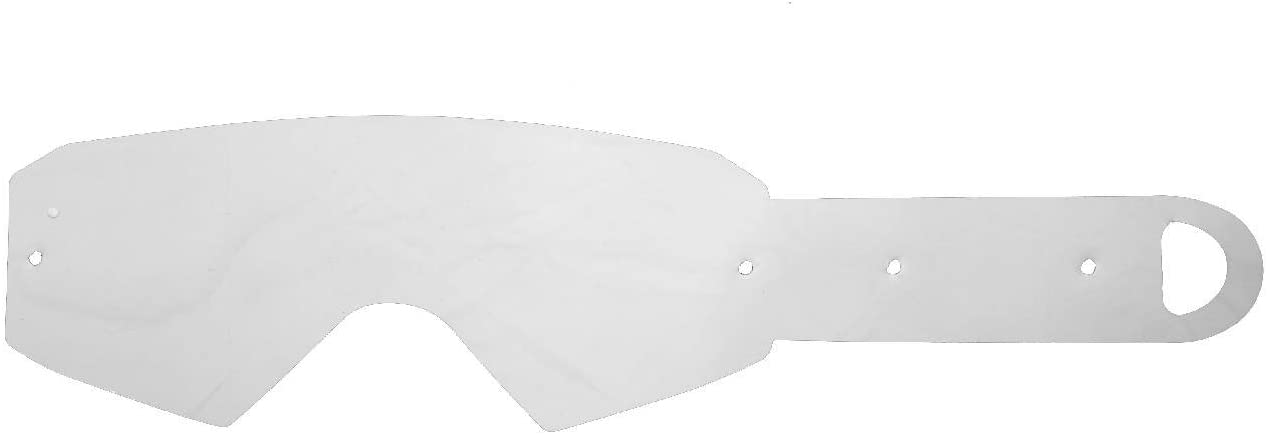

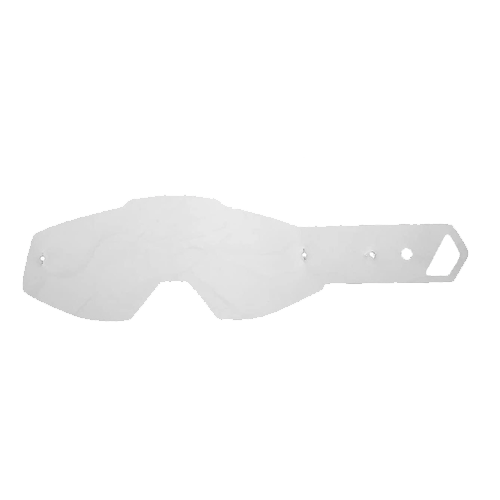

SeeCle 415145

lenti di ricambio per maschere trasparente compatibile per maschera Scott Prospect

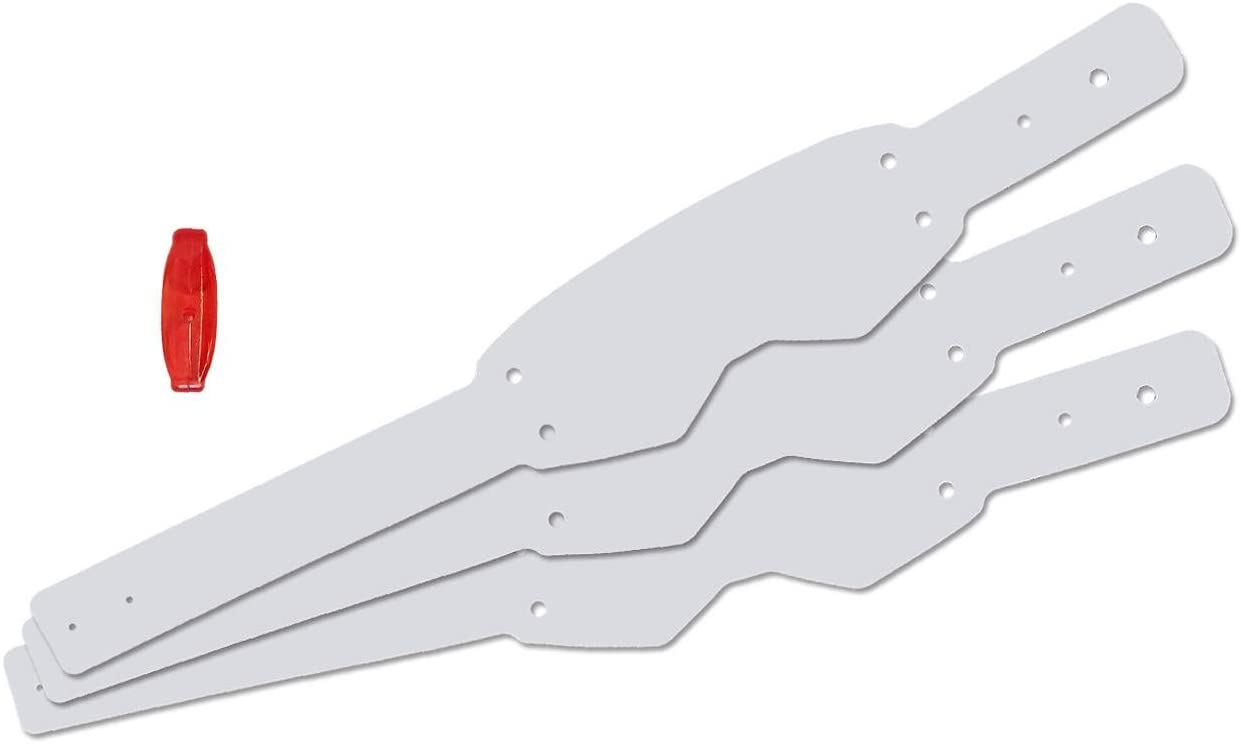

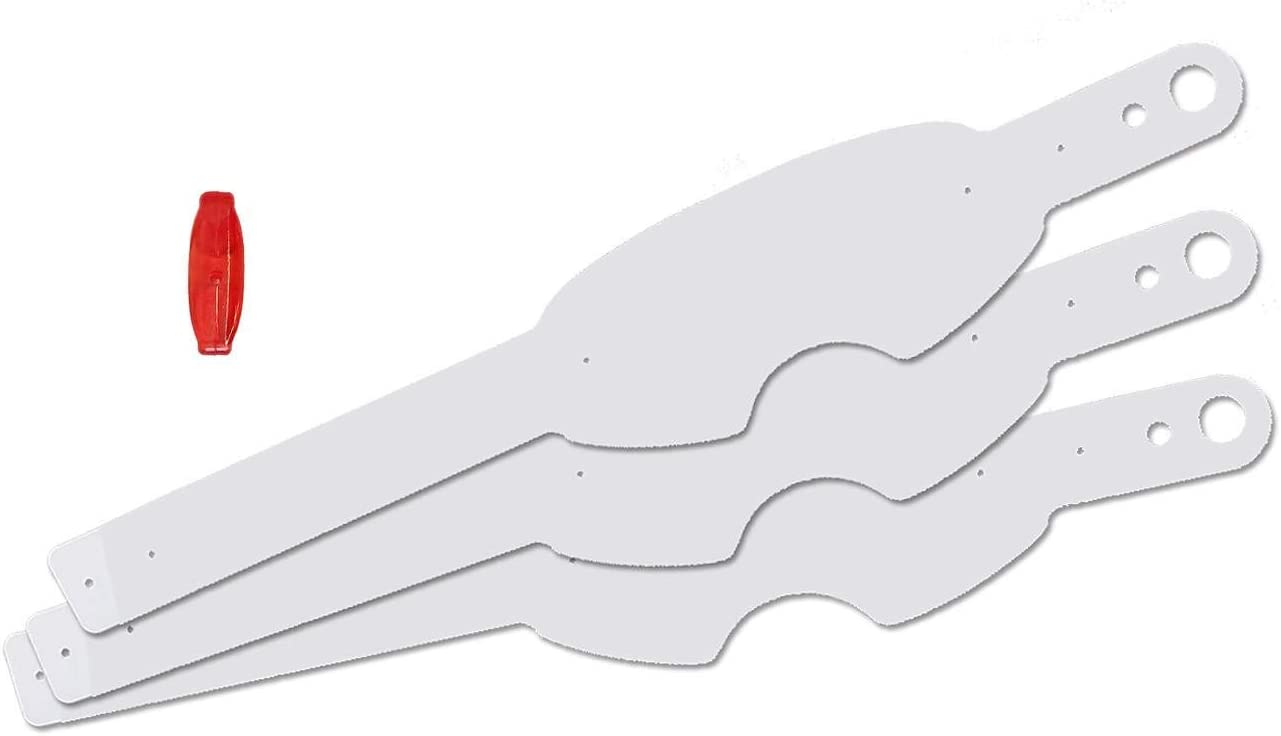

SeeCle 414832

tear off compatibili con maschera Scott Prospect kit 20 pz

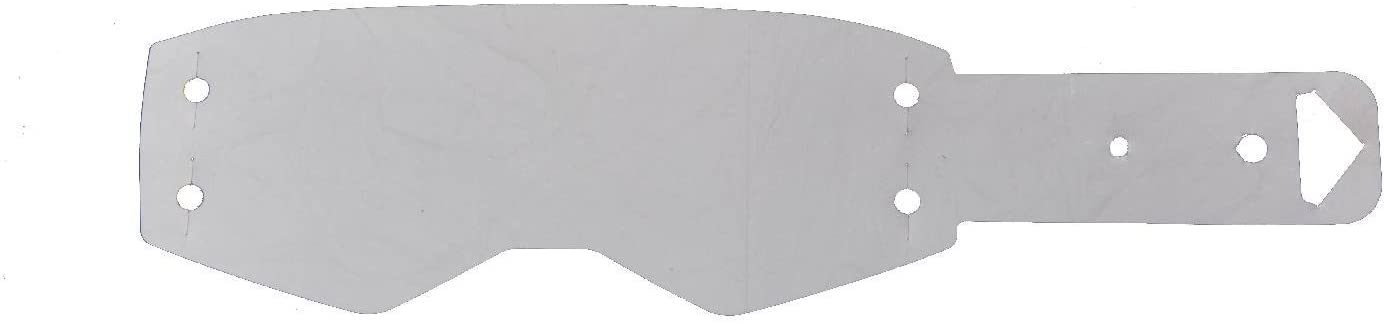

HZ 411134

lenti di ricambio per maschere compatibili con GMZ 3 / GMZ 2 / GMZ / Neox in Policarbonato Optical Quality Lexan 0.75mm

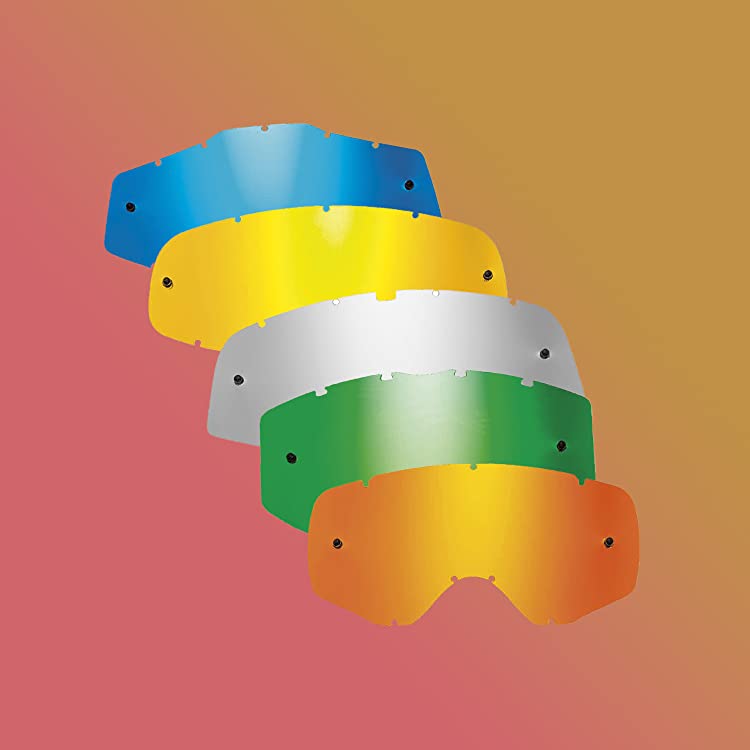

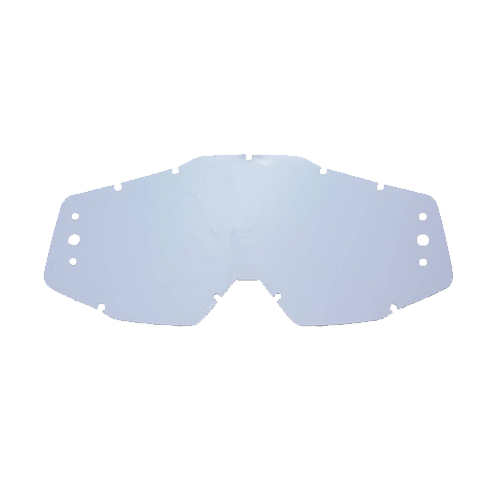

HZ 41S208

lenti di ricambio per maschere blu specchiato compatibile per maschera 100% Race / Str / Acc / Mer

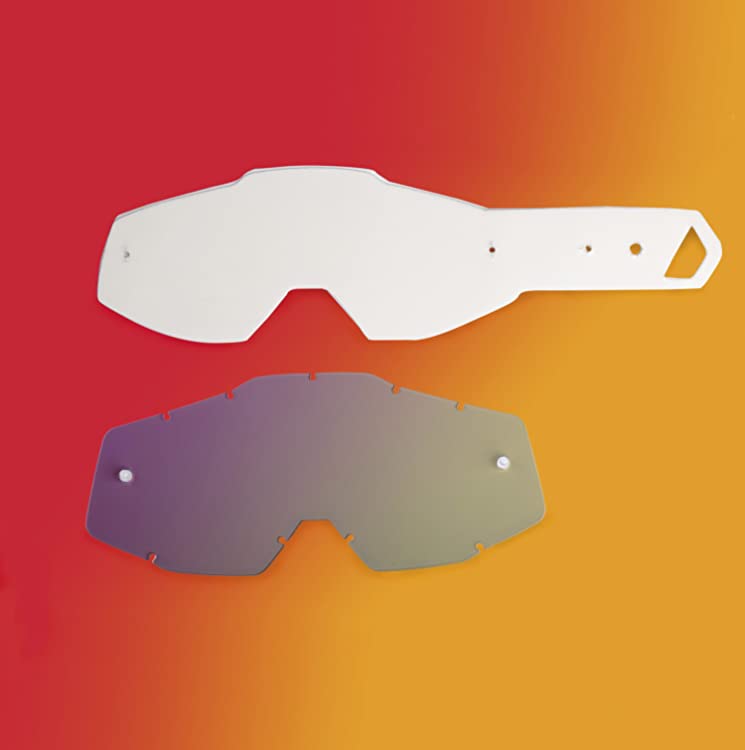

SeeCle 416015 lente piatta fumè combo

Compatibile per maschera OAKLEY Airbrake PC Optical Quality Lexan 0.75mm + 10 lenti

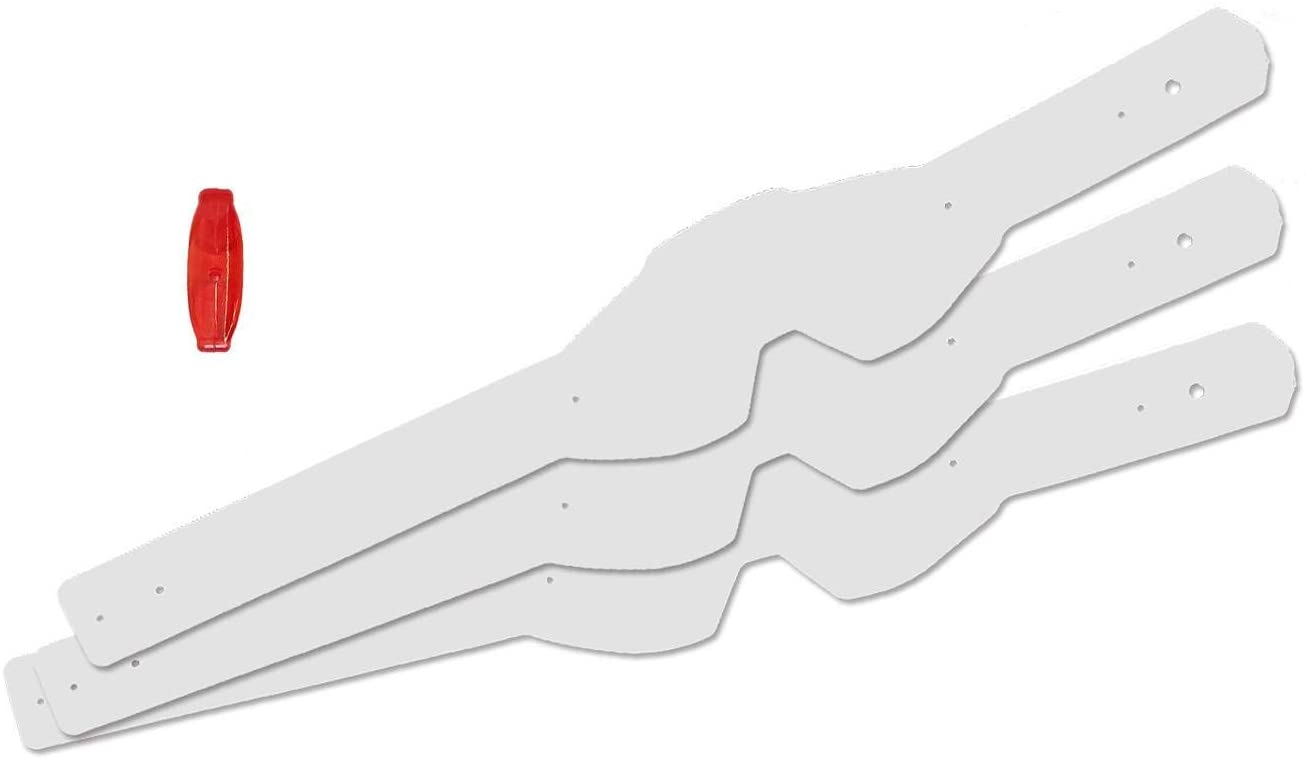

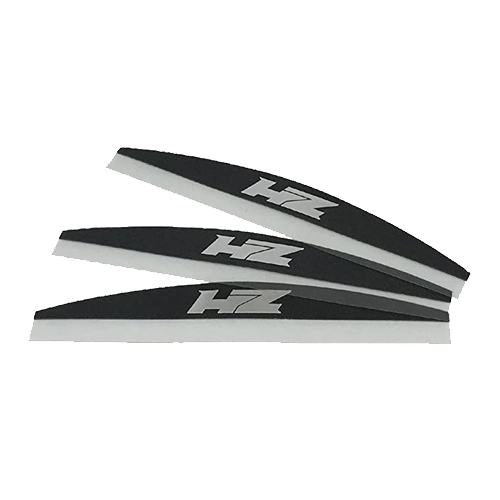

SeeCle SE-414563-HZ E.T.O.S.

sistema ecologico di raccolta tear-off compatibile per occhiale / maschera Oakley Airbrake kit 20 pz

SeeCle 41S103 kit mud device trasparente

compatibile per maschera 100% Racecraft / Strata / Accuri / PC Optical Quality Lexan

SeeCle 41C206 kit mud device trasparente 48mm

compatibile per maschera Progrip 3303 Vista